Keeping Track Of Expenses Desktop App Mac

- Keeping Track Of Expenses For Taxes

- Keeping Track Of Expenses Desktop App Mac Download

- Keeping Track Of Expenses Form

- Keeping Track Of Expenses Desktop App Mac Download

- Keeping Track Of Personal Expenses

The days of agonizing over equations in yourExcel spreadsheet budget are over. It’s 2019, and it’s time to put your moneywhere your app is. Here, you’ll learn about three financial apps you canleverage to get your expense tracking, budgeting or both under control:

- Clarity

- EveryDollar

- Mint

Oct 09, 2017 The situation with QuickBooks on Mac is a bit confusing at first glance because there’s both a Mac desktop only version and an online version of QuickBooks. QuickBooks Desktop 2020 For Mac ($299.95 per year) only works on your Mac desktop whereas QuickBooks Online works in your Mac’s browser but requires a monthly subscription. Jan 12, 2020 The Best Expense Tracking Software for 2020. Expense tracking is one of the least enjoyable aspects of running a business. Thankfully, there.

But first, maybe you’re wondering why theseapps are useful and what makes them more applicable today than traditionalmethods.

Why Go Digital

According to ABA Banking Journal, two-thirds of Americans prefer digital banking channels to traditional channels (e.g., bank branches, ATMs). In our digital age, keeping track of cash and paper records like bills and receipts is probably feels less natural and more burdensome to modern consumers.

If you’re going to use your credit card topurchase goods on Amazon or even from the brick-and-mortar neighborhood storedown the street; if you’re going set up automatic bill payments through yourbanking provider’s web or mobile app–doesn’t it make sense to also budget andtrack expenses with a digital tool?

It does! And there are several free andsubscription-based apps available that codify the knowledge and manual work ofbudgeting and expense tracking tasks so you can accomplish them withease–including Clarity, EveryDollar and Mint.

But as with any digitized service offeringtoday, there are some things you should consider when choosing the technologyyou use to manage your finances, because each app has its own strengths andweaknesses. Let’s look at what each of the apps we’re discussing brings to thetable. Install iphone apps on mac.

Clarity – For Web and Mobile

Maybe you already have a good grasp of what your regular expenses are; you commit a standard amount to savings each month; you know not to spend over a certain amount of your income before your next paycheck, ensuring you’re prepared for the unexpected.

By all standards, you may not need a budget. What you do need is a way to track your expenses. Here’s where an app like Clarity comes in.

Acquired by Goldman Sachs in 2018, Clarityoffers you an advanced way to manage your multiple bank accounts, bills andother transactions in one place, giving you a single pane of glass throughwhich you can view your financial history as well as see where and how yourmoney is moving as it enters and leaves your accounts. Here’s the kind of clarityit provides:

- An overview of your financial status, including cash, credit debt and investments

- How much you’ve spent in the last few days

- Recent income flow

- How much you have saved in your Marcus account from Goldman Sachs

- How many days until you get paid

- A monthly budget (unadjustable; more of an overview to help you plan ahead)

- An interactive feature to explore where and how you’re spending money

- Graphs and charts to visualize your financial data

- Recurring expenses to help you understand where your money is going

- The ability to cancel subscriptions or services you pay for

- Free credit score! (Always a nice extra)

- An overview of all your linked credit cards

You can dig deeper into most if not all thesefeatures to get a more detailed perspective of your finances and do someserious expense tracking.

With so many features and functions, Claritywill require some time and effort to understand the information the appprovides. But when compared with gathering all this information manually fromacross multiple sources, it greatly reduces the time required.

That’s all great. So, what’s the downside?

It’s almost as if Clarity’s strength is its weakness: information overload. While the Clarity dashboard is thorough, it can be a lot to take in, which takes some getting used to.

Due to the amount of information displayed in several charts and graphs or contained in several widgets–all in one place–it’s inevitable you’ll end up homing in on three or four specific sections of the dashboard and neglecting the rest.

Another unfortunate issue that seems to occur with Clarity is the delay in information streaming between your bank accounts and the app. Overall, it does a decent job keeping track of finances and displaying the correct cash flows, but there have been cases where it takes a couple days for Clarity to be in sync with your bank account.

If you aren’t keeping track of your bank accounts directly, this could lead you to believe you have more or less money than you actually do.

Despite these small caveats, Clarity providesplenty of options for where to focus your attention in expense tracking. If youtreat the app as an expense tracking tool to enhance rather than coordinatefinancial management with, the benefits are great for the average person who doesn’t have timeor care to get into the weeds or be overly meticulous with budgeting.

EveryDollar – For Web and Mobile

Are you a shopaholic? Do you struggle stayingorganized? Maybe one, or both, of these traits is making it difficult to paybills and purchase necessities on a month-to-month basis. Just trackingexpenses won’t keep you in line. You need something to direct your actions: abudget.

Then again, maybe you’ve already tried this. “It doesn’t work. I can’t stick to it,” you say. You’re not alone. A Gallup poll found only one in three Americans keep a long-term budget.

But with an app like EveryDollar, budgeting can be simplified, even made enjoyable believe it or not, which can put you in that 33 or so percent of Americans who diligently plan their finances. Soon enough, you’ll be kicking bad habits of overspending and be watching your savings grow.

EveryDollar is perfect for anyone new tobudgeting, but it’s also a great tool for the Excel pros who want details. Itprovides a templated budget that’s smart enough to remember recurring expensesand input them for you each month, plus calculate increases or decreases insavings, investments and debt based on input values. Additionally, you cantweak the template to include more unique budget items that aren’t alreadydefaults.

Essentially, EveryDollar takes Excel’sequations and cells and puts them behind a modern interface that’s easy foranyone to understand. The beauty of the app is all you have to do is point andclick and enter data inputs.

Moving on from the budgeting feature, what’snice about EveryDollar is it’s more than tool–it’s a knowledge base. Developedby finance guru Dave Ramsey’s namesake company, Ramsey Solutions, EveryDollarembodies all the best practice from Ramsey’s years of experience in financialplanning and budgeting.

Under the Baby Steps section of the app,EveryDollar provides a visual, phased journey of goals you can follow, startingwith Baby Step 1, Emergency Fund, and ending with Baby Step 7, Build Wealth andGive.

Again, the app is smart enough to keep track of where you are on this journey based on what it processes from your budget.

That is, once you reach the savings goal for an emergency fund in Baby Step 1, EveryDollar will automatically move you forward to Baby Step 2, Pay Off All Debt Using the Debt Snowball. Additionally, there are tips included for each step to make your journey towards financial well-being a little easier.

Moving deeper into this idea that EveryDollaris more than just a budget and also a knowledge base, a third feature offerstools to help you find local providers for insurance, tax services, retirementand investing, and buying and selling a home.

What’s great about EveryDollar is the advancedbut intuitive budget feature with the huge plus of being a knowledge base thatguides you towards financial security, rather than just leaving you to figurethings out on your own. So, what’s the downside?

Something as simple as expense tracking ends up costing you extra if you want it. Just to connect your bank accounts and credit cards, as well as receive support, will cost you $10.75 a month, or $129 a year, and not for the depth and breadth of expense tracking you get with Clarity for free.

Then again, boosting your membership to Pluswith EveryDollar could be worth it if you’d rather not keep two apps–one forexpense tracking, one for budgeting–and would prefer to keep everythingcentrally located in one very smart and easy-to-understand app.

Mint – For Web and Mobile

As you delve into the practice of digitally managing finances, you’ll quickly come to understand much of the process is a matter of preference when it comes to how comfortable you are with the robustness, or lack thereof, a tool offers.

But if you’re looking for the ultimate everything-in-one app to manage your budget and expense tracking, it might be difficult to find anything competitive to .

Keeping Track Of Expenses For Taxes

Mint offers everything Clarity and EveryDollardo in its own flavor, from expense tracking to budgeting to a credit check. Inyour overview dashboard, you get a nice display of:

- Accounts

- Bills

- Credit score

- Create budgets

- Goals

- Financial trends

- Investments

- Ways to save

But as with Clarity, there’s a lot to dig intohere. What’s different is Mint is more robust once you start digging. Ingeneral, Mint is insanely more detailed than the two other apps we’ve coveredhere, but its makers at Intuit are also conscious of the people who don’t havetime to dig into and understand that level of detail and prefer a higher levelview with some direction.

Here are some examples of features Mintoffers:

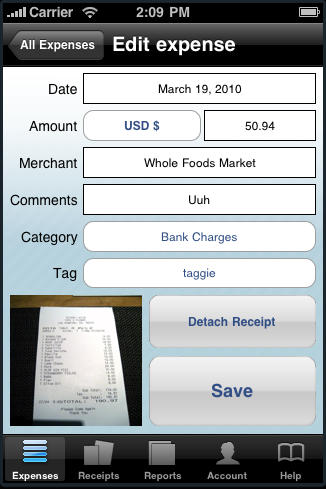

Transactions

The transactions tool is fantastic, as itemulates what you would see in a banking app, which means you don’t have toworry about getting used to a different layout or process of scrolling throughexpenses. A unique feature here is the ability to tag (i.e., label)transactions to group them into categories, making them easier to find andanalyze from a higher level.

Bills

Mint gives you a simple overview of bills dueeach month as well as cash available, credit available, and payments you’vemade. A unique feature is a billing cycle calendar that allows you click on datesto see if/when bills are due as well as add bills you want to be notified of topay on specific dates.

Jun 09, 2020 To help protect you online, here's the Best Antivirus Software for Mac of 2020: Webroot Bitdefender Intego Kaspersky Norton ESET AVG Technologies Trend Micro F-Secure. Apr 12, 2020 The best free antivirus platforms for Mac in 2020 Malwarebytes Anti-Malware for Mac. Windows users have long turned to Malwarebytes’ free version as a backup for. Avast Security for Mac. Avast Security for Mac is one of the most popular security suites available, and it’s easy to. Free antivirus for mac downloads.

Budgets

While Mint’s budgeting tool is advanced,EveryDollar’s seems easier to move through and manage. This could be an areafor Mint to improve upon. There’s nothing too complex about the feature, butthe layout and process for managing things aren’t as intuitive as they couldbe.

Goals

This is a fun tool comparable to EveryDollar’sBaby Steps, but perhaps even more robust. The difference is in content. UnlikeEveryDollar, Mint’s feature offers several calculators to help you determinehow to accomplish paying off credit card debt, saving for an emergency, buyinga new car and much, much more.

ViewYour Financial Trends

This is where you can generate graphs tovisualize your finances. Unlike Clarity, you have more options forcustomization across spending, income, net income, assets, debts and net worth,which can help you build a better understanding of everything. If it soundslike a lot, don’t worry, Mint offers suggestions for graphs to try, knowing noteveryone is going to have time to analyze 50 different visuals.

Ways toSave

Here’s another fun tool Mint offers, givingyou the ability to browse other financial products–credit cards, checking andsaving accounts, 401k rollovers, IRAs and more–to see where you can get thebest bang for your buck. It’s just one more way Mint tries to help you besmarter with your finances.

But keep in mind, to be as smart as Mintallows you to be with your finances, you have to be willing to spare the timeand effort.

Keeping Track Of Expenses Desktop App Mac Download

Conclusion

Clarity is free and gives you the information it believes the average personneeds to ease the process of expense tracking. It takes some getting used toand some attention, but it can enhance your financial management by centrallylocating all your cash flows.

EveryDollar takes the capabilities of an Excel budget and packages them into anintuitive and smart interface that hides most of the meticulous work requiredto coordinate a budget. But if you want expense tracking, you’ll have to payfor it.

Keeping Track Of Expenses Form

Mint bundles together the best of budgeting and expense tracking to offer abreadth and depth of insight to help people at every stage of understandingtheir finances. If you truly want the entire package and don’t want to pay adime, Mint is a dream come true. But you can’t expect to get much value from itif you’re not spending a few days a week delving into everything itoffers.

Keeping Track Of Expenses Desktop App Mac Download

Deciding which app is right for you comes down to preference and understanding what level of guidance you need to help you stay on track.

Keeping Track Of Personal Expenses

An app as high-level as Clarity might just tell you what you already know, or an app like Mint might just overwhelm you. Our recommendation is to roll up your sleeves and try each app for yourself. Once you find your fit, you’ll be ready to start managing money smarter in the digital age.